Property investment opportunities rising in the west, setting in the east

Article by: Craig Francis

Source: API Magazine

November 22, 2022

Perth is the only capital city market rated as a ‘rising market’ and its affordability compared to cities such as Sydney and Melbourne has placed it on the radar of property investors nationally.

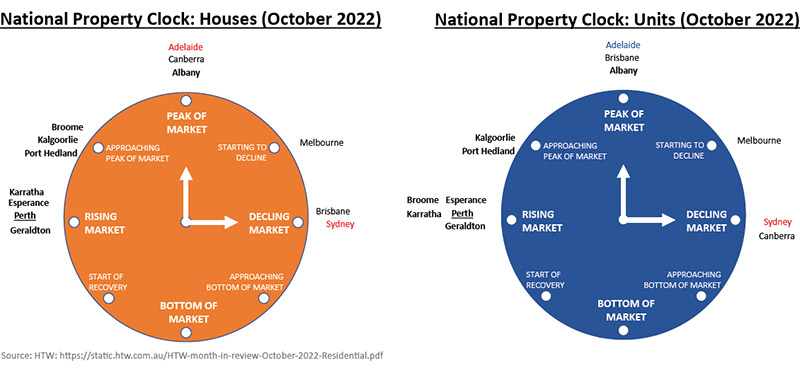

While the clock is ticking on the Sydney, Melbourne and Brisbane property markets that are past their peak, Perth has been identified as the only capital city in Australia to be declared a ‘rising market’.

According to the Herron Todd White (HTW) October 2022 National Property Clock tracking of the nation’s major housing markets, Perth is the only capital city market on an upward trajectory for detached houses and for multi-units.

All of WA’s major regional markets are also either classified as being a ‘rising market’ or as ‘approaching the peak of market’.

REIWA data released Tuesday (22 November) highlighted the strength, and affordability, of the regional market. In the south west of the state, Busselton’s median house price rose 5.4 per cent to $648,000 during the quarter, while Bunbury’s increased 2.5 per cent to $410,000.

Busselton was also the top performer annually. Its median house price increased 22.3 per cent on the same time last year. was second for price growth with its median rising 12.9 per cent to $460,000.

Toby Adams, Executive Manager Research, Urban Development Institute of Australia WA (UDIA WA), said Perth’s status as a rising market largely reflects the far more modest pricing increases experienced through the COVID-era than were witnessed across the eastern seaboard.

“While pricing is now starting to retract in these overheated east coast markets, pricing in Perth and across most regional markets has remained firm and is still increasing modestly in certain sub-markets.”

Affordability is unquestionably one of the appeals of the Perth market to interstate investors earning the same wages as West Australians but confronted by property prices that can be more than double a comparative Perth dwelling.

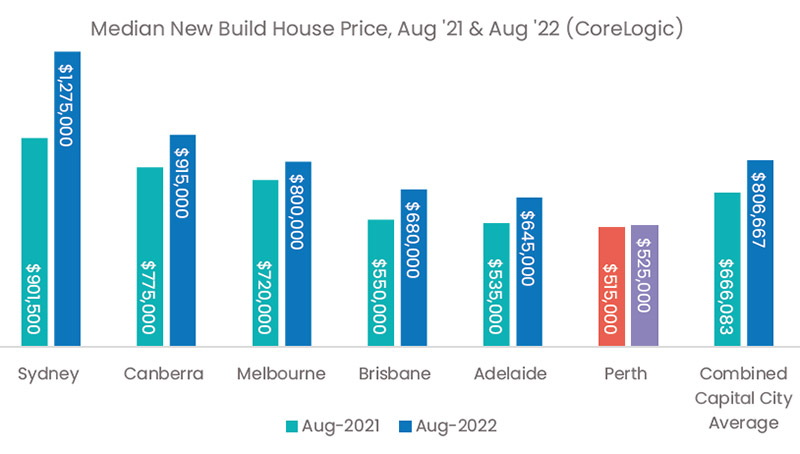

CoreLogic’s latest pricing data underscores this point with Sydney’s median new house price jumping an eyewatering $373,500 in the 12 months to August (to $1.25m), followed by Canberra’s increasing $140,000 (to $915,000) and Adelaide’s up $110,000 (to $645,000), while Perth’s median new house price increased only $10,000 to $525,000.

Affordable investment

Perth’s investment allure is highlighted by the massive gulf in housing supply available for less than $600,000.

While more than half (56 per cent) of Perth properties fall below that benchmark price, only 11 per cent of Sydney properties can be bought on that budget, while Canberra (22 per cent), Melbourne (25 per cent) and Brisbane (38 per cent) further reinforce Perth’s relative affordability.

The difference between Perth and Sydney house market is even more stark. Just over half of Perth houses are listed below $600,000 compared to an almost non-existent 1.8 per cent in the harbour city.

Within Western Australia, borrowers are relatively quiet, whether they’re buying their first home or investing in a portfolio of properties.

Monthly owner-occupier lending volumes for established market properties is down 21 per cent year-on-year (YoY), although it is still 8 per cent above the monthly average over the decade.

September saw a marked slowdown, with owner-occupier lending for total new housing loan commitments across WA down 16 per cent. First-home buyers are shying away from property, with the state’s First Home Buyer Grants paid for new house and land packages down 15 per cent from the previous month, and lower by a massive 55 per cent compared to a year ago.

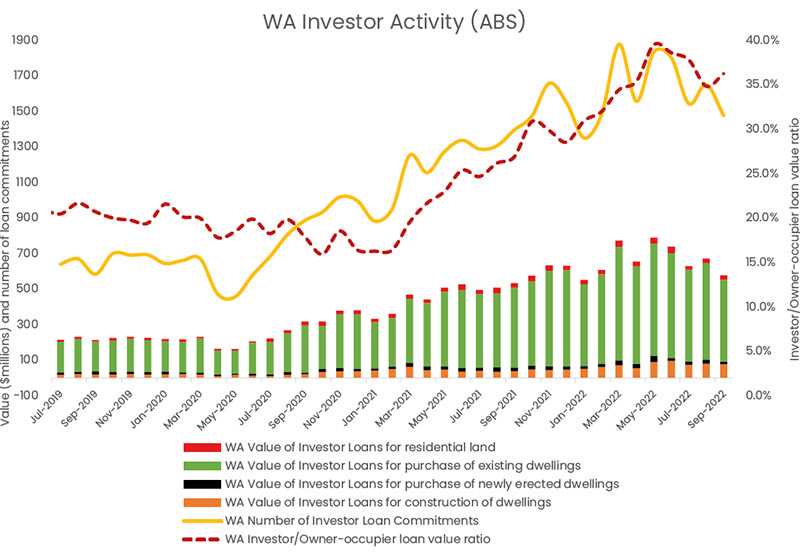

The number of WA investor loan commitments decreased 11 per cent in a month, compared to fall of 9.3 per cent nationally.

Over the course of the year though, the value of investor loans in WA has risen 32 per cent, in clear contrast to the national decline of 14 per cent.

Strategic Property Group’s Managing Director Trent Fleskens told media that east coast buyers who had benefited from passive growth over the last decade in their home states were being drawn to Perth’s low prices, historically low vacancy rate, high rental returns and strong capital growth prospects.

He said an outer suburban home worth $350,000 in Perth would sell for $1 million in NSW, yet attract the same amount of rental income.

Flying off the shelves

REIWA CEO Cath Hart said the Perth property market continues to be resilient compared to other states and credits the strong Western Australian economy, resources sector and housing affordability.

“It is pleasing to see Perth home values were relatively stable in October; to put things into perspective, Brisbane’s home value index declined 2.0 per cent and Sydney’s declined 1.3 per cent,” Ms Hart said.

“The main drivers for this are the low level of stock and our affordability, with Perth median house prices the cheapest of any capital city – there is nothing in the Perth property market right now indicating that house prices will fall drastically any time soon.”

The fastest-selling suburbs in October were Camillo and Golden Bay (five days), followed by Safety Bay, Warnbro, Langford, Orelia, Carlisle, Huntingdale (six days), with Seville Grove and the only north of the river suburb Padbury recording a median of seven days to sell.

“We are still seeing Perth houses being snapped up at a remarkable rate, with no indication of it slowing down despite interest rate rises,” Ms Hart said.

“In a balanced market the median time to sell a home would be 30-40 days, so a median of 15 days really means prospective buyers should have all their ducks in a row to avoid missing out.”

REIWA President Joe White said regional Western Australia was still tracking well, with most areas showing growth or remaining stable over the quarter.

“Annually, all regional centres have seen growth over the past 12 months,” he said.

“Busselton has been a consistently strong performer over the past few years, both quarterly and annually, which is driven by population growth,” Mr White said.

“There are three mining companies that fly out of Busselton, so the area is attracting FIFO workers who come down to enjoy the lifestyle.

“There is also an increase in the work-from-home/micro business trend; the idea of having to live where you work has changed significantly post-COVID and we’re seeing a lot of growth in the 25-35 age bracket who are choosing to enjoy the South West lifestyle.”

Builders in a bind

UDIA WA’s Mr Adams said dwelling approval volumes are viewed as a lead indicator for forward property market performance and economic activity within the building sector and broader economy.

“Dwelling approvals also provide a useful indicator of the strength of consumer and investor confidence,” he said.

In September, dwelling approvals registered across Western Australia retracted 20 in a month, to be down 29 per cent down on 12 months earlier, and 36 per cent below the long run average.

But the apparent shift in sentiment was more down to an inability of the building industry to deliver than a lack of demand, Mr Adams said.

“Clearly developers’ forward expectations of new dwelling commencements have softened significantly from this time last year, but this is more a reflection of capacity to deliver new supply, and soaring construction costs, rather than signalling a significantly reduced demand profile,” he said.

“The retraction of approvals is currently being experienced across most of the nation’s major housing markets with national approvals down 17 per cent year-on-year, however, there is considerable variability across the capital cities and major regional markets in terms of the current stage of the market cycle.”

Dwelling approvals in WA lean heavily to houses, with 87 per cent of approvals in the past year being for detached houses compared to the national average of 62 per cent. A record 21,030 detached houses were under construction across WA in the June 2022 quarter.

Apartments represent just 10 per cent of approvals, whereas nationally that figure is 21 per cent.

Perth’s median price for newly built houses in August was $525,000, increasing by 3 per cent since July 2021.

The lack of approvals and building labour shortages, much of it driven by the mining sector’s demand for workers, is only exacerbating the rental crisis that is particularly acute in Perth.

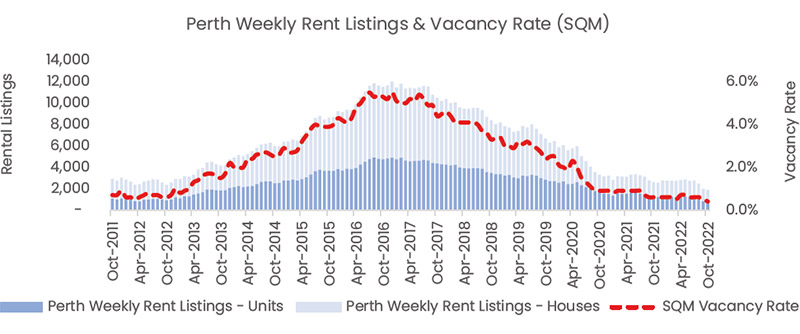

The residential vacancy rate for Perth plunged to 0.4 per cent for October, the tightest market in more than 17 years.

Units are becoming scarcer by the day.

Weekly unit rental listings for Perth decreased by 11 per cent over the month to 751, which was 40 per cent below levels from the same time the year prior.

Median weekly rents continue to trend upward with asking prices for houses, up 15 per cent for the year to $606 per week. Unit rents were also up 15 per cent YoY to $464 per week.

It took a median of 15 days to lease a rental during October.

Suburbs recording the fastest median leasing times were Hamilton Hill and Hammond Park (seven days), followed by Quinns Rocks (eight days), then Port Kennedy, Coolbellup, Carlisle, Aveley, Beckenham, Applecross (10 days) and Nollamara (11 days).

Currently, Perth is the capital city that our research is driving our clients to for optimal investment outcomes. Keep an eye out for our upcoming report on Victoria, and the opportunities we feel this market will present from early to mid-2025. CPA Property Reports are the ultimate research tool for those considering an investment into the any Australian property market.