Rebound in property demand “phenomenal” as CBA forecast higher 2020 prices

Article by Property Observer, Joel Robinson

Source: Property Observer

November 14, 2019

Commonwealth Bank have updated their forecast for the 2020 dwelling markets on the back of the resurgence over the last few months.

They now expect national dwelling prices to grow six per cent in 2020.

CBA senior economist Gareth Aird has called the rebound in demand “phenomenal.”

“Back in July we updated out dwelling price forecasts and extended the profile to end-2020,” CBA senior economist Gareth Aird said.

He noted however that they only expect modest price rises over H2 2019 and 2020.

“We flagged that the risks to our forecast profile were to the upside, but a V-shaped recovery was not our central scenario,” Aird added.

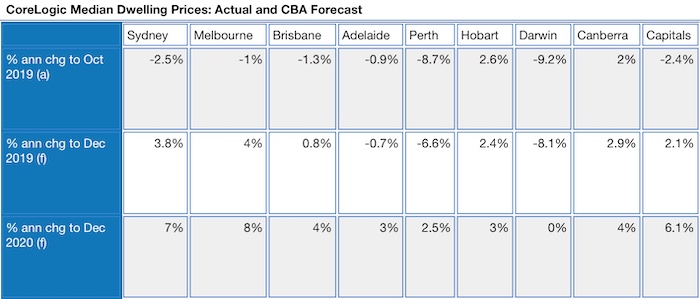

Commonwealth Bank expect Sydney and Melbourne to drive the national forecast, each to be up seven and eight per cent.

To enlarge, click here.

Brisbane and Canberra will follow with four per cent gains, with Adelaide and Hobart house prices to grow three per cent.

There’s finally good news for Perth and Darwin.

After major losses, the two strong mining capitals aren’t expected to see declines in 2020. Perth is forecast to see 2.5 per cent growth, while Darwin will remain flat.

National dwelling prices have risen 3.7 per cent since bottoming out in June, however they still remain seven per cent below the September 2017 peak.

Aird says there are two key downside risks to their view on property prices.

“First, the reintroduction of macro-prudential measures to slow the growth in lending,” Aird stated.

“Measurers introduced a few years ago to slow both the rate of growth in lending to investors and rate of growth in interest-only lending were successful in slow dwelling price appreciation.

“Second, a lift in the national unemployment rate above 5.5 per cent would likely result in dwelling prices not lifting as much as we expect.”

Aird also cited two key upside risks to CBA’s forecasts, the first being if there is another cut in the official cash rate.

“We expect one further 25bp cut to the cast rate in Q1 2020 which should result in a further reduction in mortgage rates,” Aird said.

“But any move to UMP (unconventional monetary policy) that results in mortgage rates moving lower than we expect would likely result in dwelling prices inflating by more than we anticipate.

Aird added that if there were to be any further policy changes to boost housing demand such as first home owner grants or lower stamp duty, to domestic or foreign buyers, then prices could go higher than the forecast.

Currently, Perth is the capital city that our research is driving our clients to for optimal investment outcomes. Keep an eye out for our upcoming report on Victoria, and the opportunities we feel this market will present from early to mid-2025. CPA Property Reports are the ultimate research tool for those considering an investment into the any Australian property market.